An Introduction to RPA

Welcome to ‘Part 3’ of our Intelligent Automation blog series. If you haven’t read ‘Part 2’ yet, please click here.

In this part of our IA blog series, we will spot the light on Robotic Process Automation (RPA) and how it has changed the way organizations work.

Gartner defines Robotic Process Automation (RPA) as “A productivity tool that allows a user to configure one or more scripts (which some vendors refer to as ‘bots’) to activate specific keystrokes in an automated fashion. The result is that the bots can be used to mimic or emulate selected tasks (transaction steps) within an overall business or IT process. These may include manipulating data, passing data to and from different applications, triggering responses, or executing transactions. RPA uses a combination of user interface interaction and descriptor technologies. The scripts can overlay on one or more software applications.”

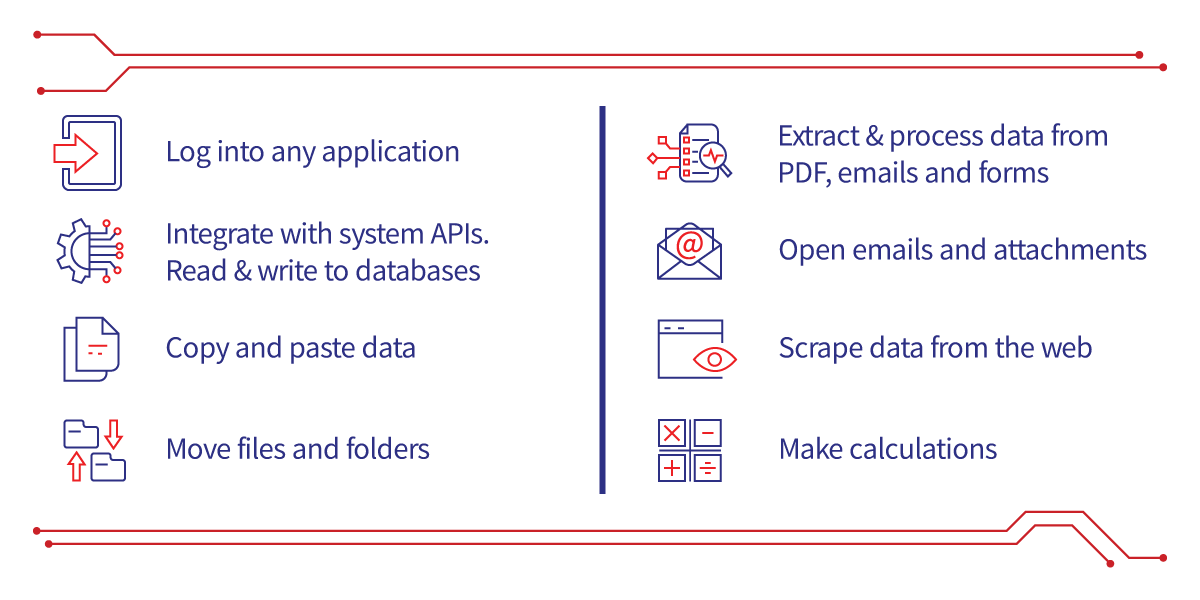

Since bots can utilize the user interface to work, there is no need to change systems or applications in order to automate a process. Furthermore, bots can work with systems and application in two ways:

- Attended bots: RPA bots which sits on the users’ machine and interacts with them to help with task execution and to boost productivity.

- Unattended bots: RPA bots that can run a process independently and on its own in order to achieve end-to-end automation.

RPA has been able to make a reputation of being a relatively simple technology, easy to use, and quick to deploy, however, it is crucial to select the right processes for RPA in order to tap into the huge potential of this technology and to sense the benefits of deploying it in a digital workforce.

There are best practices and clear strategies within the RPA framework to pick the processes most suitable for RPA. Here are some of the characteristics for an RPA candidate process:

- A rule-based process that follows a logical sequence.

- A highly repetitive process with high-transaction volumes.

- A stable process that depends on structured or semi-structured data.

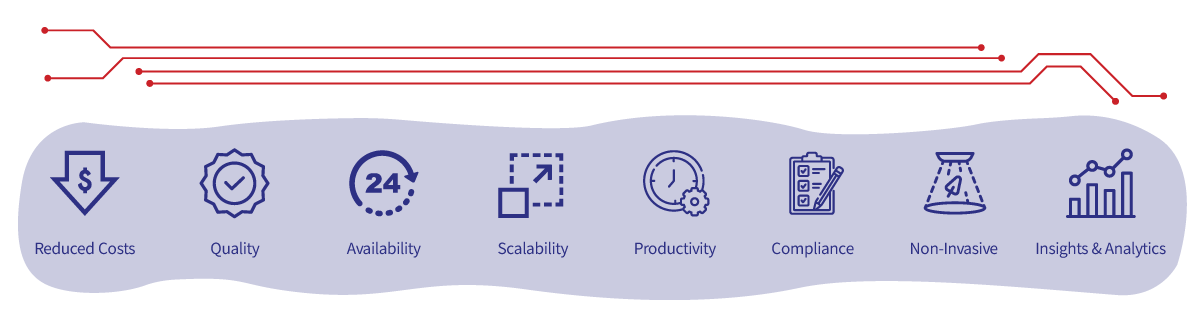

Organizations across all industries can benefit from automating rule-based and repetitive processes. RPA enables finance, banking, insurance, healthcare, and many other sectors to transform their operations and to realize measurable outcomes and benefits such as:

- Reduced Costs: Reduced spending on FTE for back-end processes opens up opportunities to reinvest or take efficiency dividends.

- Increased Quality: Quality of outputs is increased as chances of error are reduced significantly.

- 24/7 Availability: Bots operating 24/7 can reduce workload peaks and improve response time.

- High Scalability: Bots can be scaled up and down as required – for example, to manage high volumes in peak times of the year.

- Increased Productivity: Staff can be liberated from mundane and repetitive processing tasks and focus on value-added tasks.

- Increased Compliance: RPA tool provides full audit trail of processes performed and those that are rule-based.

- Non-Invasive Technology: No need to change the underlying systems or technology as RPA is deployed on top of the systems and applications.

- Insights & Analytics: All activities are captured and visual dashboards can be created to identify areas for improvements.

According to McKinsey, “automating business processes through RPA can lead to a return on investment between 30-200% in the first year after implementation, and to 20-25% savings on average.“

An optimal utilization of RPA for maximum gains is to run the repetitive, rule-based processes by the digital workforce, and to allocate the human workforce for the tasks which require human strengths such as human judgement and complex reasoning, emotional intelligence, or communication skills.

Let’s take an example of a bank statement reconciliation process. It’s a common use case across many organizations under the finance function and it ticks all the boxes for the RPA process selection criteria. The core of the bank statement reconciliation process is to reconcile the organization bank account balance against its cash account balance to understand the current cash position at any point in time. It is rule-based, repetitive, and a high-transactional process where accuracy can’t be compromised.

In a manual bank statement reconciliation process, staff performs the following activities:

- Accesses the online banking and downloads the account statement for a certain period of time. This activity is repeated for each bank and each account.

- Opens the core system and generates the cash balance sheet report for the same account and for the same duration.

- Manually reconciles the transactions in the bank statement report against the transactions in the cash balance report based on a certain criterion such as transaction amount and transaction date.

- Prepares a report for the reconciliation results (reconciled transactions, unreconciled transactions) and sends it to the concerned party for review and action.

- Repeat steps 2 to 4 for each bank statement.

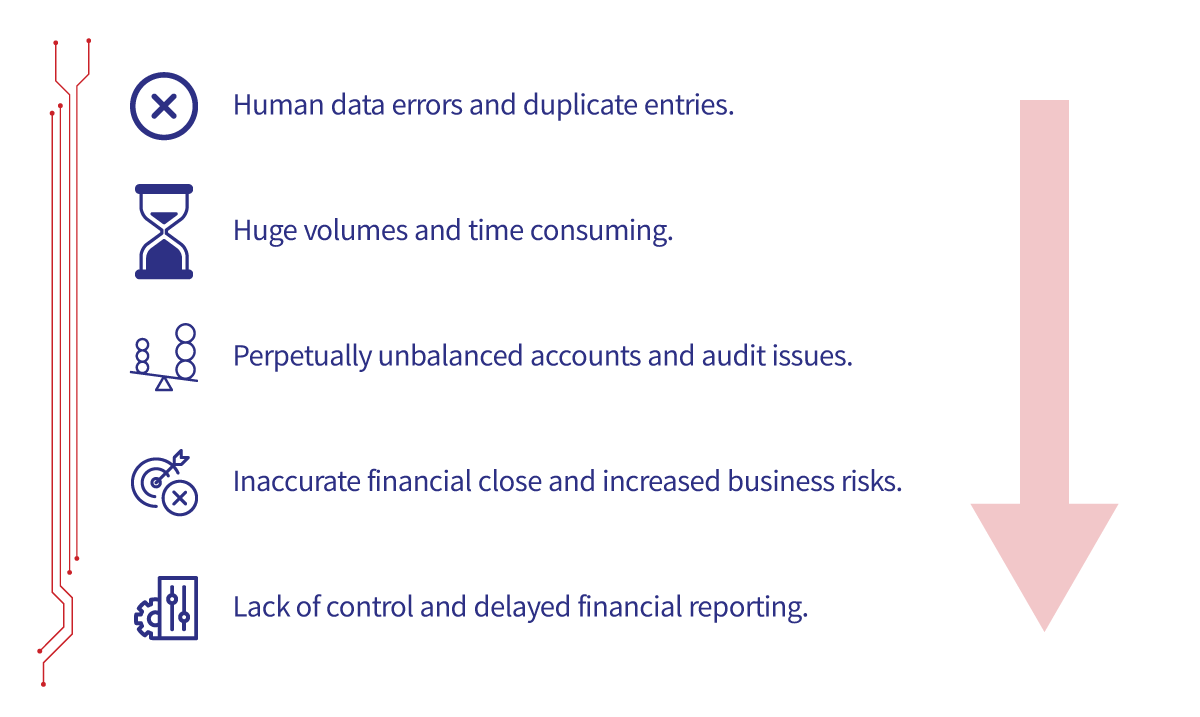

When it comes to checking and matching transactions manually, there are a few challenges which can be encountered especially for organizations that deal with a bigger number of account types, institutions, payment types, time zones, and payment complexities. These challenges include:

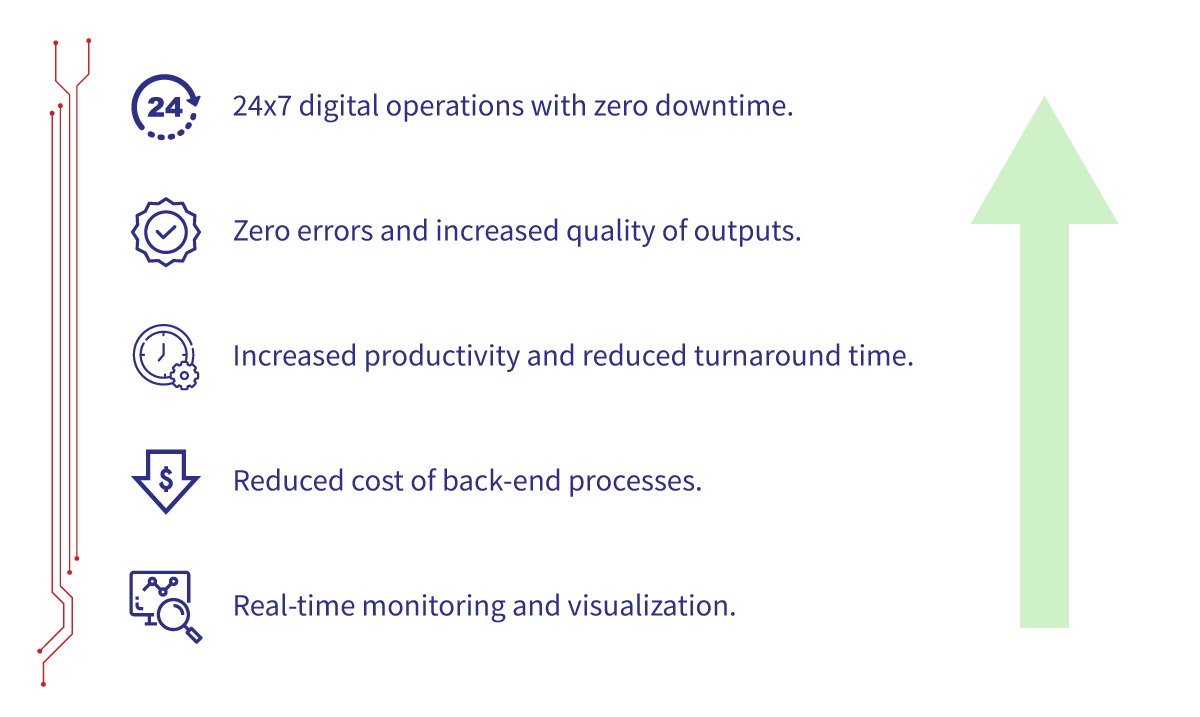

RPA can bring automation to the manual bank statement reconciliation where a bot can perform the repetitive tasks of reconciliation and can work with the systems just like a human does, but more quickly, accurately and with zero margin for error, even for huge volumes of transactions. As a result of this automation, a range of benefits can be introduced like:

Similarly to the robotic bank statement reconciliation process, organizations can recognize the same benefits of RPA with many other processes and functions within several sectors. Below we mention some of the most common RPA use cases:

Banking:

Banking:

- Customer digital onboarding

- Card activation

- Compliance screening and KYC

- Outward transfers processing

Insurance:

Insurance:

- Create/update/delete policy

- TPA reconciliation

- Quote generation

- Payment and receipt vouchers

Finance:

Finance:

- Bank statement reconciliation

- Vendor statement reconciliation

- Exchange rates real-time update

- Invoice processing

Human Resources

Human Resources

- Employee onboarding

- Time and attendance management

- Payroll processing

IT

IT

- Reset password

- User management

- Periodic backup

- Email related tasks

In the recent years, many organizations have started to see RPA as a key component of their digital transformation strategy. While the definition of RPA is straightforward, the concept and mechanism can be easily misunderstood.

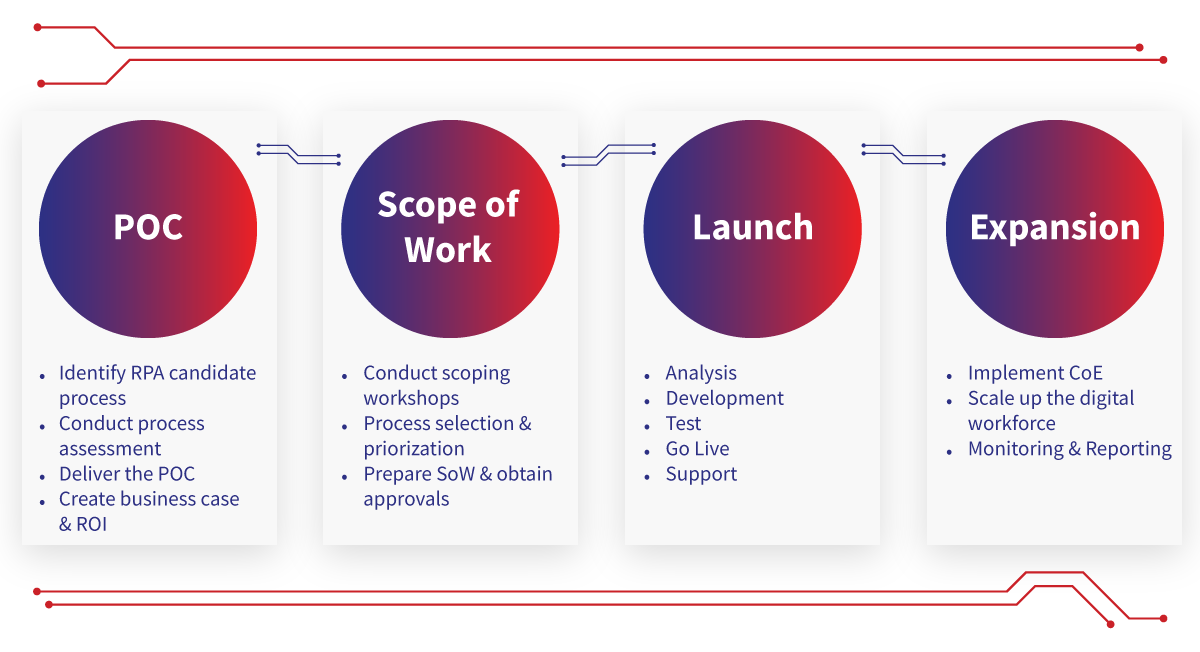

In order to implement RPA in a proper manner, we will have to understand the overall RPA implementation roadmap. The below figure describes the stages of the RPA roadmap and the main activities required in each stage:

The RPA Roadmap can arm organizations with the information and strategies they need to set a solid foundation for the RPA journey. Aspire can help organizations effectively use RPA to boost productivity, improve accuracy and grow the business.

You can successfully implement RPA when you have the right team with you. Aspire is committed to devote its knowledge and experience to setup the proper implementation framework and to advance on a transformative RPA initiative. We empower organizations to implement, run, and scale up a digital workforce with the aim of saving costs and attaining business continuity. Are you considering automating your repetitive business tasks but don’t know where to begin? Speak to our RPA team today, we are here to help you every step of the way.

Written by: Mohammad Keswani, Manager of RPA Solutions